Welcome to RCNH Financial

Established in 1990, Rare Coins of New Hampshire enjoys an excellent reputation within the financial services and numismatic industries for its unrivaled technical expertise and consumer protection practices. The firm of choice by many broker dealers, portfolio management firms, RIA’s and estate planning attorneys, RCNH has provided precious metals and numismatic expertise for many notable organizations such as Virginia Tech University, The Gettysburg Foundation, The Heritage Institute, Utah Valley University as well as The State of Vermont’s Department of Taxation. RCNH is a member of all major professional organizations including the most prestigious and exclusive consumer protection organizations in the industry, The Professional Numismatists Guild and it’s precious metals affiliate, The Accredited Precious Metals Dealer program. PNG and APMD are nonprofit organizations composed of many of the top precious metals, rare coin and paper money experts in the country. PNG and APMD provide anti-fraud hotlines to consumers as well as redress with binding arbitration. In addition, RCNH provides technical precious metals and numismatic market expertise to legal firms throughout the United States who represent consumers who have been involved in unethical tangible asset related transactions. Notably, Rare Coins of New Hampshire has recently received recognition as one of the “100 Most Influential Companies” in the precious metals and numismatic industries by Amos Press.

For over 34 years, RCNH Financial has provided disciplined, reliable and personalized precious metals and numismatic acquisition and liquidation strategies to deliver great results for investors. Precious metals and numismatic coins play fundamental and important roles in a well diversified investment strategy by providing:

- A diversifier that can mitigate losses in times of market stress.

- A liquid asset with no credit risk.

- A means to enhance an overall investment portfolio performance.

- A source of long term returns.

RCNH Financial provides many services for investors and financial advisors such as:

- Custom designed precious metals and numismatic investment portfolio strategies designed to grow and preserve wealth.

- Portfolio management services that keep investors and financial advisors current on market opportunities that are emerging for profit in existing portfolios.

- Tangible asset appraisal services by RCNH Financial’s industry recognized experts.

- Personalized exit strategies and guidance for precious metals and numismatic coins designed for ease and the maximization of prices at the time of liquidation.

Donald W. Dee: Director, RCNH Financial

Donald W. Dee serves as the Director of the Financial Services Division at RCNH, a distinguished numismatic firm renowned globally for its unparalleled technical proficiency and commitment to consumer protection. With a background in the precious metals and numismatic industries since his graduation from the University of Massachusetts, Donald has amassed over 30 years of experience collaborating with financial professionals. RCNH Financial, under his leadership, is accredited and extensively vetted by numerous broker-dealers, Registered Investment Advisors (RIAs), portfolio management firms, and estate planning attorneys. Donald is a sought-after speaker, frequently appearing on radio and television programs across the United States and Canada to share insights on precious metals and numismatic investments. As a published author, he has cultivated markets for precious metals and numismatic investment portfolios in the United States, Canada, and Saudi Arabia. Furthermore, Don was recently a guest lecturer, invited to speak to Masters of Business Administration students at Utah Valley University—the largest public university in Utah. During the lecture, Don delved into the significance of precious metals and numismatics as strategic investment assets. Don was also recently chosen to be a member of the Board of Advisors for The Heritage Institute: the global pioneer in Heritage Process research, training trusted professional advisors since 2003 with an unmatched wealth of intellectual property, processes and professional advisor training.

Follow Donald W. Dee on LinkedIn

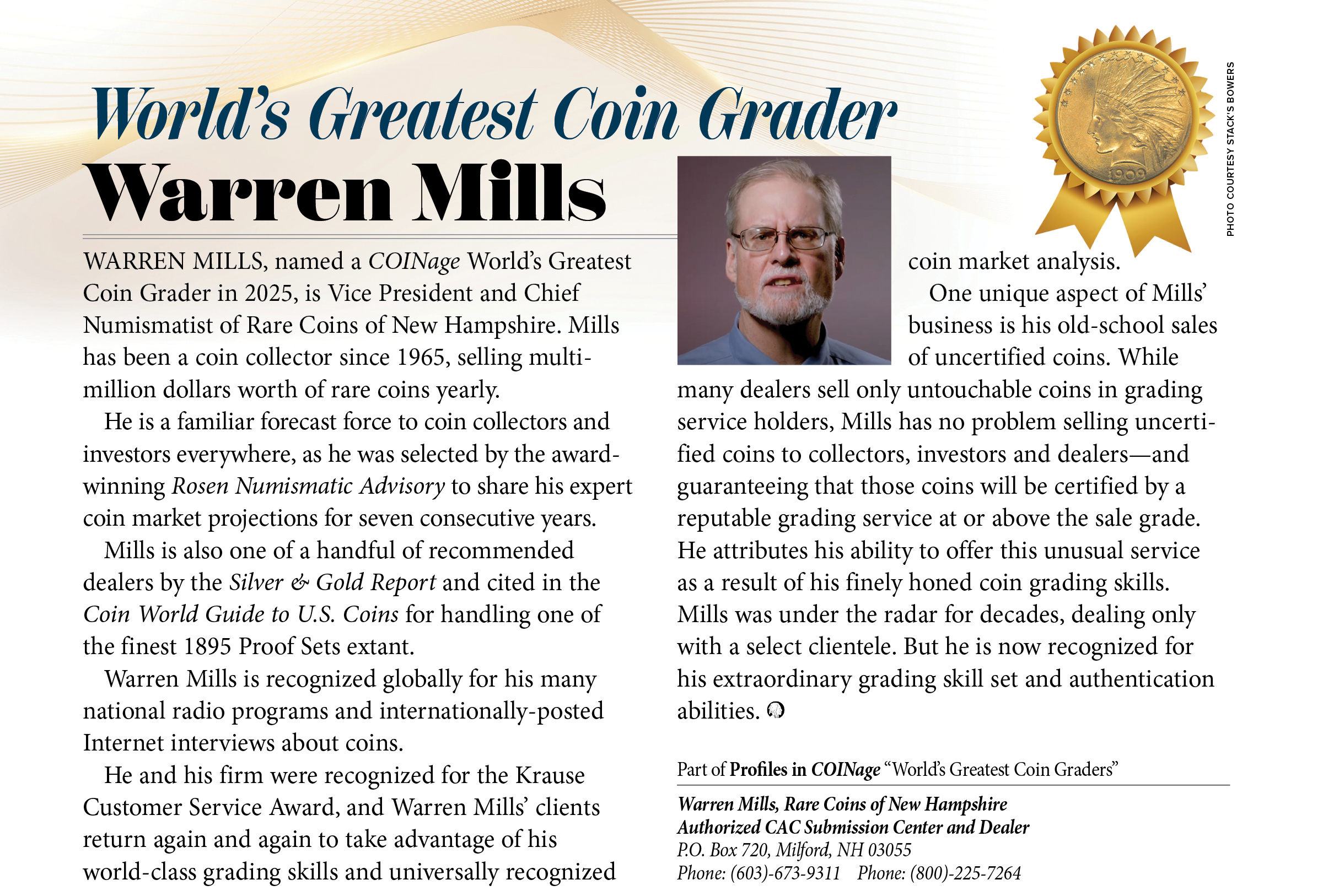

Warren Mills, Founder and Chief Numismatist of Rare Coins of New Hampshire, named World’s Greatest Coin Grader 2025 by COINage Publications.